Before I start, it’s important to know that I’m not writing this to convince anyone to send money. We’ll be OK, truly. I’m writing this because much like depression, shame withers in the light. I don’t want the specter of “what if someone finds out” to live in my brain, rent free. And perhaps hearing our misfortune will help someone else avoid a similar one.

In order to understand how someone could have $12,518.42 stolen from them without noticing, it’s important to explain our situation over the past 18 months or so. Because on the surface, the notion of losing that much money and not noticing seems like wealth and privilege at an incomprehensible level. If exposing financial information makes you uncomfortable, you might want to click away, because I’ll be using some real numbers.

In the middle of the pandemic, my job changed. Part of that change included no longer receiving employer-sponsored healthcare. I receive a generous stipend, but it doesn’t come close to covering a solo plan. So we added some out of pocket money to the stipend, and started paying for COBRA. (That allows us to keep the healthcare from my last job, paying the full premium plus administrative fees for up to 18 months)

We also have adult children in their early 20s. They were underemployed thanks to the pandemic, and we have been helping them make ends meet. Plus, Donna’s part-time teaching position was even more part time this past school year. Add to that a massive repair bill on my aging pickup truck, existing debt from our barn experience — and the stage is set for a pretty rough financial gauntlet.

With our new expenses and decreased income, it was clear that we would be making less than we spend every month. We had about $17,000 in the bank, and about $20,000 of credit available across our 5 credit cards. Knowing that would only keep us afloat temporarily, we started doing everything we could to add income while decreasing expenses. Sadly, most of our expenses are fixed, and while we could have canceled Netflix, that small savings in the middle of a pandemic didn’t seem worth it. Anyway, we were going deeper into debt every month, but surviving.

Donna took as many sub positions as she could on the days she wasn’t teaching. I worked my DayJob as a sysadmin, and then started cartooning, writing, and creating training videos for YouTube. While my efforts might smack a bit of mid-life crisis, the bulk of my previous career was making training videos, and I’d been a professional writer for years at Linux Journal. The only oddball item was my daily comic, but since I found the process relaxing, it was almost a daily therapy session for me.

So for the past year plus, we’ve been using credit cards for everything possible, and paying the minimum balance due, with additional payments as more money came in. We knew our credit card debt would rise, and our bank account would dwindle, but the hope was to slow the bleeding until I started to bring in some serious revenue from my after work endeavors. It would certainly take a while, but the clock we were trying to beat was a combination of “not running out of money and credit” plus “we have 18 months of COBRA”.

I’d like to say we had a clearer plan, or even a more succinct goal. Unfortunately, we just had stress, chaos, and a faint hope that “something” would give. Perhaps I’d get a job offer that included benefits. Perhaps the school where Donna worked would offer a medical plan. Maybe my YouTube channel would take off, or my comic would go viral. But what it actually meant was many, many credit card charges, and many, many payments to credit cards coming out of our shrinking checking account.

And that’s how it happened.

Back in September of 2021, lost in our myriad of credit card payments, a new credit card payment posted. “Credit One Bank” took an ACH payment for $182.95 out of our account. That’s about the size of other credit card payments that constantly come out of our account, and at first glace I assumed it was our Meijer credit card, which is a branded card from one of the countless credit companies.

As the months went on, there were more and more payments from “Credit One Bank”, all varying from the $100-$300 range, which again, matched our other credit card payments surprisingly close. Looking back, I should have seen it. Of COURSE I should have seen it. There were 4 days in a row where $182.75 was taken out. And while I don’t remember seeing those payments, I probably saw them and assumed I was looking at the same payment. But I didn’t notice.

See, our account balances were changing in just the way we expected them to change. Our credit card debt was rising, and our bank account was shrinking. That’s not ideal, but it wasn’t unexpected. And so we weren’t suspicious that something was wrong. We saw that our money was going away faster than we hoped, and so we focused harder on making more money, not picking apart our bank statements. Heck, we probably subconsciously avoided looking at our bank statements, because we knew it would only add stress to an almost unbearably stressful situation!

And then this month, August 2022, 11 months after that first “Credit One Bank” payment snuck into our life, we ran out of money. Our mortgage payment bounced because its auto-withdrawal happened a couple days before my paycheck was deposited. I had already moved the posting date, because I saw the writing on the wall, but even that only kicked the can down the road a month. Our checking account was in the red, we’d gotten multiple overdraft fees applied on top (because other smaller payments were trying to clear after the account went negative). And only a couple of our credit cards had credit available at all.

It’s embarrassing. And it sucks. But things like Twitter verification, a Wikipedia page, and a well-known-in-certain-circles name does not always equal the underlying financial success it hints at.

So anyway, my paycheck posted, and our account was limping along in the black again. Since our credit was about dried up, we’d been strategically deciding what to pay and when to pay it. So our credit card payments, even the minimum amount due, had to be timed to our paychecks. And that brings us to this week. Yesterday, in fact. My paycheck wasn’t due to post until today (the 18th), and I was watching our account balance like a hawk, making sure nothing tried to clear before my paycheck was in there. And wouldn’t you know it, Credit One Bank was posting a payment for $168.64.

I KNEW I hadn’t made a payment, because after the mortgage fiasco, our balance was too low for that. And so when I logged in to all our various credit card accounts, trying to figure out why one of them automatically made a payment, I couldn’t find a payment for that amount. Anywhere.

And of course then I started looking at our account history, and quickly realized what I should have realized 11 months ago. Someone was making a credit card payment with our account, but it wasn’t us. Or at least, it wasn’t only us. As I searched the transaction history, I found that over the past 11 months, there have been 54 payments taken out. The dates and amounts are fairly random, but vary from $100-$350 or so. And added together, they equal $12,518.42. It turns out that initial $17,000 we had in our account wasn’t dwindling as quickly as we thought, or at least we weren’t “dwindling” it.

I spent most of yesterday talking to the bank, and to the police. Today I have to drive back to the bank (and hour drive, one way, ugh) to finish closing our compromised account and set up a new one so we can continue making our mortgage payments, car payment, and credit card payments. And now, I need to fight to get money back from “Credit One Bank”, even though in my communications with them yesterday have proven to be anything but helpful.

Our bank, Straits Area Federal Credit Union, has shifted a bit. At first, they told me all they could do was stop further withdrawals by charging me a $25 stop payment fee. But after talking to the police officer as I filed a report, he encouraged me to go physically to the main office, and talk to someone a bit higher up the food chain. I’m glad I did, because now they’re going to reimburse me for the previous 60 days, and for some reason the first 60 days of fraudulent charges. Assuming that happens (I’m signing paperwork today), it will put $4,595 back into my new account. The remaining $7,923.37 will likely never get recovered. But I will be sending all the information to “Credit One Bank”, and hoping they do the right thing. Regardless of the outcome, it will take months before I know anything.

I’m not gonna lie, while that $4,595 will be incredibly helpful in the short term, we’re clearly still teetering on the edge of disaster. Thankfully, there’s a bit of good news in this bleak story.

When summer started, Donna clearly couldn’t get anymore subbing jobs, so she applied for a part time position at one of our favorite places on earth. McLean & Eakin Booksellers. She got the job, and I’ll be honest, I’ve never seen her love what she does more than when she’s working at the bookstore. The owners must recognize how much she was made for the job, and without prompting, called Donna in to offer her a full time, year round position. And believe it or not, this small town, independent bookstore provides health insurance for their full time employees.

Health. Care. Insurance.

Our COBRA eligibility runs out in November, and we did not have a plan for what we were going to do after that. The middling insurance plan I was quoted to buy on our own was over $30,000/yr, and that was without dental or optical. Donna getting a job that provided healthcare was unexpected, and the most amazing news we’d gotten in a very long time. I don’t even know what the plan will look like, but it honestly doesn’t matter, because whatever the benefits include will be more than that nothing we could afford once November hits.

I cried like a blubbering idiot. And that, I’m not ashamed of.

Look, we’re far from being financially stable. My napkin math shows that we have about $65,000 in credit card debt, one mortgage with $60,000 remaining, another with $100,000 remaining, and a car loan with $13,000 still outstanding. My DayJob isn’t in immediate jeopardy, but I maintain datacenters for servers that operate in the cryptocurrency world, so longevity and stability are not guaranteed. But in spite of this current financial setback with Credit One Bank, we actually have a bit more hope than we’ve had in a while.

Donna will be working full time, starting some time before November. My YouTube channel was recently monetized, and while it’s only bringing it $100 or so a month, it’s a start. I’ve been working with an editor about a potential book deal, and while my comic hasn’t taken off — I still really enjoy it, and perhaps someday others will enjoy it too. I’ve even built up enough content on YouTube, that I don’t feel bad starting a Patreon page for people who want to support my creative endeavors. (It’s not live yet, but once I get the patron benefits sorted this week, it might be one more trickle of income)

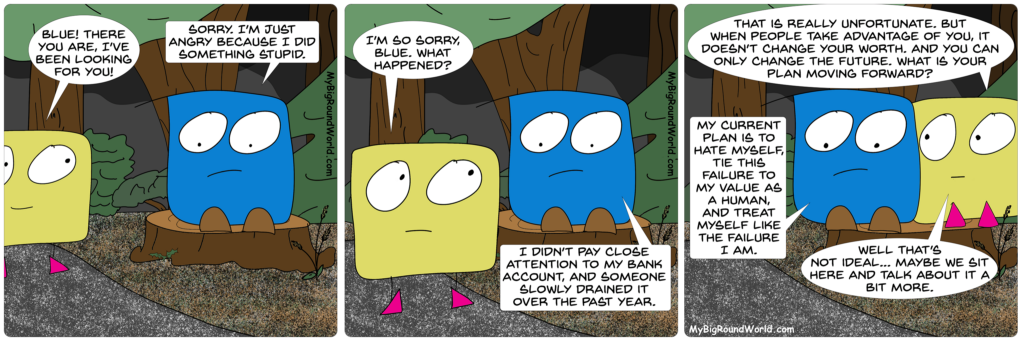

So yeah. It’s been a rough month. But it’s also been a good month. We really will be OK, and my intent is certainly not to make anyone worry about us. We didn’t fall for a scam, and yet we ended up losing the bulk of our “cushion” in arguably the worst time ever. My hope is that everyone looks a bit closer at their checking account after reading this, and if you do end up a victim of bank fraud — know that someone else’s evil is not a character flaw of yours. Be kind, maybe especially to yourself. It’s easy to be like Blue, and since I draw him, I know it first hand.

I can relate to this a lot. I was laid off for a year while JoDee was doing adjunct work. Of course the bills don’t stop coming so we raised our debt while I looked for work. Hoping that things can get sorted soon (I can’t imagine having a parasite draining away at you while you’re struggling)

Shawn, thanks for sharing your tragic story with us. Thanks for sharing your “you’ period. The learning, the comics, the YouTubes (yes, even the animated GI Joe knockoff), and stories like this. Even when your world is effed, your writing skills are still quite phenomenal. You really excel at bringing out the truth and emotion of your stories.